Introduction ✨

Every trader has a setup they just love — the one that feels almost like a signature move. For me, that’s the BOF, or Break of Failure. 😎

As I mentioned in my previous article, I always think differently from most traders. Instead of following the crowd, I look for sweeps or liquidity grabs — places where other traders are likely to be caught off guard. This setup is a 5 minute timeframe trade, so it’s a bit slower than my usual scalp trades, but it has become my personal favorite for good reason.

I won’t go into every tiny detail of the entry conditions — otherwise, I could write a full novel. But I’ll give you a clear look into how I approach this setup and why it works so well.

Waiting for the Right Level ⏱️

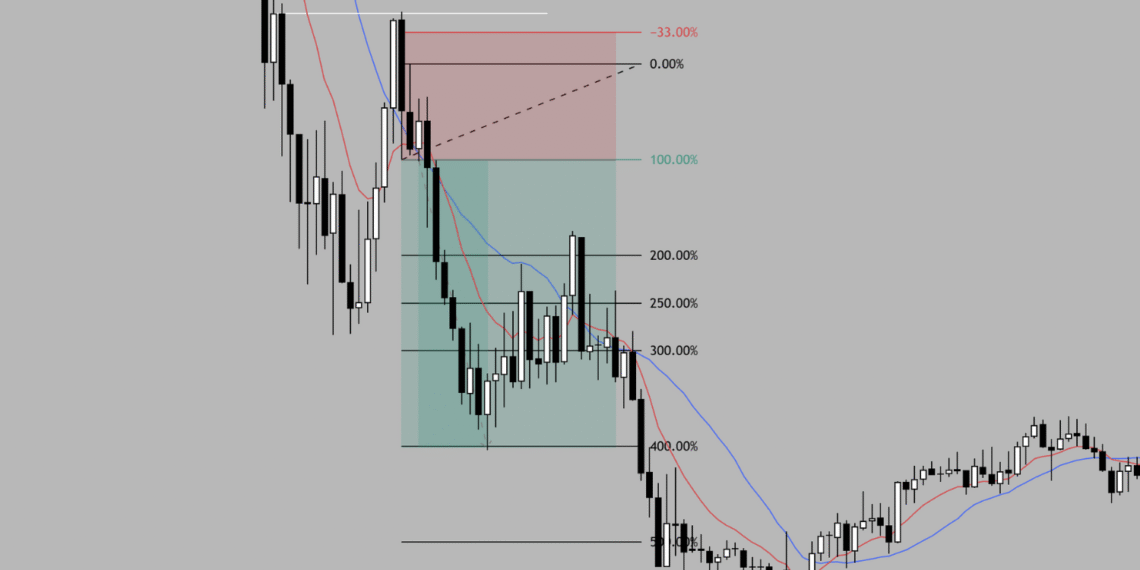

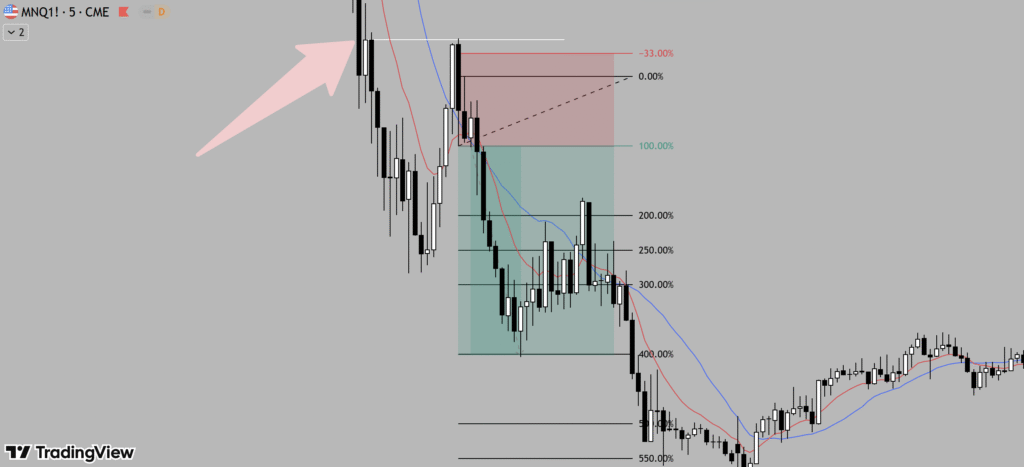

The first step is always waiting for price to reach a specific level I’m watching closely. In this case, the price reached a level marked on my chart (I’ve highlighted it with a pink arrow).

As always, I also check a confirmation timeframe, usually 3x the trading timeframe. This helps me see the bigger picture and avoid false moves.

Catching the Pause 🕯️

Once price reaches the key level, I wait for a candle that shows exhaustion — a small stall or hesitation that signals the momentum is weakening.

When I spot this, I immediately measure my risk management to decide how many units I want to enter. Depending on the situation, I may wait up to 4 candles for a limit trigger, but usually it’s faster.

Once this is set, I simply wait to see if the trade hits stop loss or profit 😅. The fun part? With this strategy, if the trigger fires, momentum usually pushes the trade very quickly toward TP or stop. It’s fast, precise, and thrilling.

Watching the Trade Unfold ⚡

In this example, the price moves toward TP smoothly — no sweat, no hesitation.

Of course, it’s not always this perfect, but roughly 75% of the time, it behaves similarly.

I always take my profit, because the Nasdaq is unpredictable. Even if a trade looks great, the price can turn in seconds, and floating profits can vanish just as quickly.

Multiple Conditions, Multiple Confirmations ✅

I have a lot of conditions before I take a position. I won’t list them all — sometimes sharing them just causes confusion 😅.

What I do check in this setup:

- 3x higher timeframe RSI panel

- EMA and SMA on the higher timeframe chart

- RSI, EMA, and SMA on the trading timeframe chart

All these confirmations give me confidence to enter and manage my trades effectively.

The Power of the BOF 💎

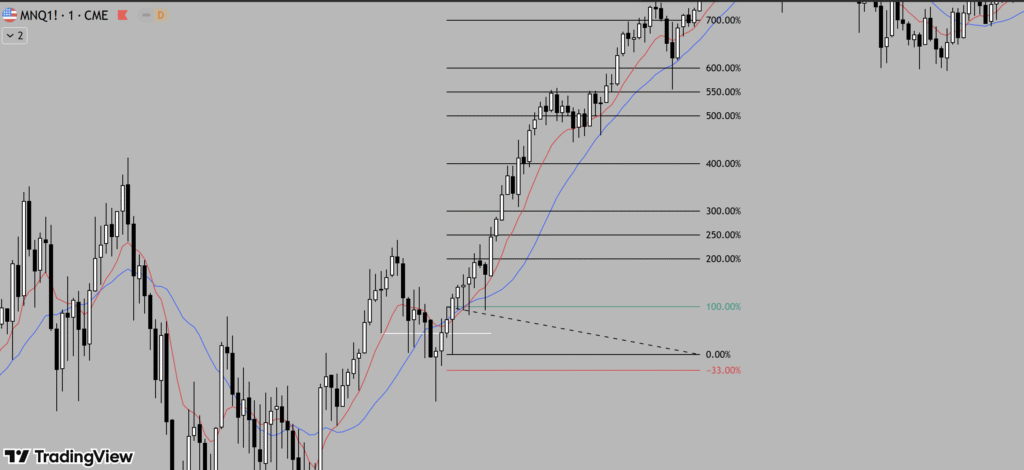

In this trade, for example, the 400% Fibonacci level was hit with a 1.1k tick move.

- On MNQ (Micro Nasdaq Futures), entering just 2 micro contracts at that level could mean 1k profit in a single day. I’ll also show a long setup example in BOF on the 1m timeframe. 😎

Is that enough? 😎 Absolutely.

This setup shows why patience, observation, and precise entry rules can generate huge opportunities in futures trading.

Why I Love This Setup ❤️

- It follows my philosophy — trading opposite to the crowd, waiting for exhaustion signals.

- It uses multi-timeframe confirmation, which increases probability.

- It’s fast and repeatable — trades usually resolve quickly toward TP or stop.

- The potential reward is massive, especially in futures markets like MNQ.

- It keeps me disciplined and focused, even when watching multiple charts at once.

Even though it’s a 5-minute setup, it perfectly matches my trading style and personality. Quick, precise, and high-probability moves are exactly what I enjoy.

Conclusion 🎯

The BOF (Break of Failure) is my favorite setup because it combines market observation, exhaustion patterns, and disciplined risk management. It’s fun, profitable, and aligns with my scalping and short-term trading mindset.