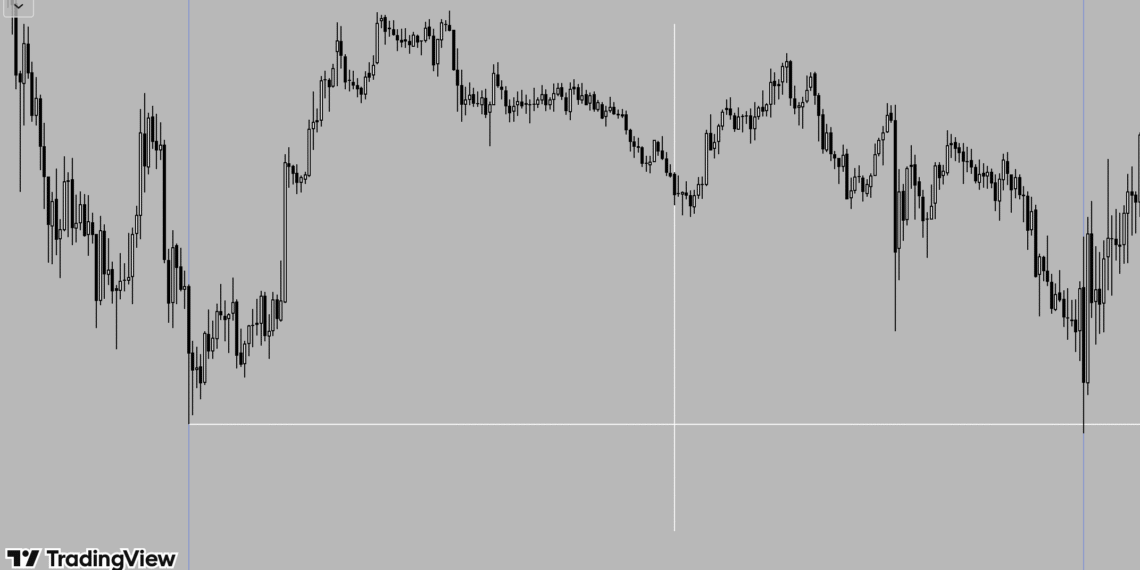

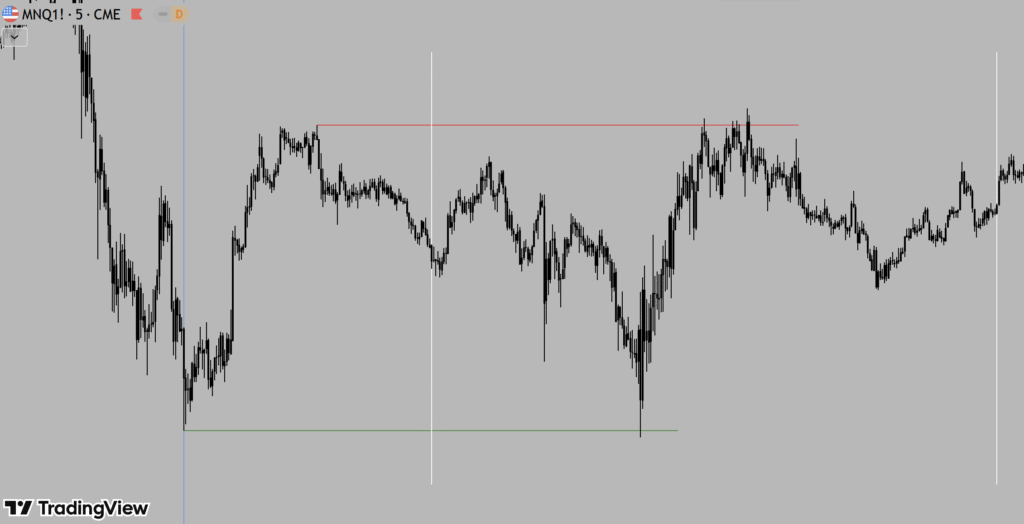

1. Daily High & Daily Low

The Daily high and Daily low represent the highest and lowest price reached during the current trading day. These levels define the day’s range and often act as natural areas of support and resistance.

Why Daily High & Low Matter

- They show where buyers or sellers lost control

- Breaks or rejections often lead to strong momentum moves

- Many stop-losses and breakout orders are placed around these levels

How I Use Them

- Rejection at Daily High/Low → potential reversal or scalp

- Clean break and acceptance → continuation trade

- Price returning to these levels later in the day often creates high-probability reactions

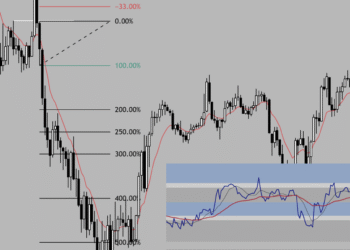

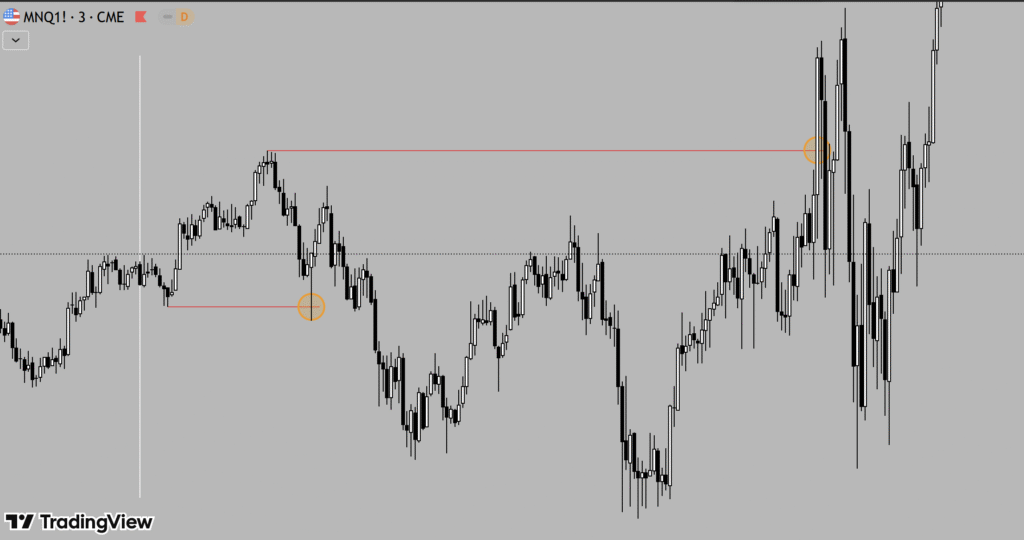

2. Previous Day High & Previous Day Low

The Previous Day High (PDH) and Previous Day Low (PDL) are some of the most important reference levels in intraday futures trading. These levels represent unfinished business from the prior session.

Previous Day Low (PDL) & Previous Day High (PDH):

Why Previous High & Low Are So Important

- Institutions track them as key reference points

- They often act as liquidity pools

- Price frequently reacts strongly on the first touch

Typical Market Behavior

- Rejection at PDH/PDL → fade or short-term reversal

- Break and hold above/below → trend continuation

- Fake breakouts around these levels are very common

Trading Insight

I rarely trade these levels blindly. I wait for confirmation such as:

- Market structure shift

- Strong volume reaction

- Failure to continue after the break

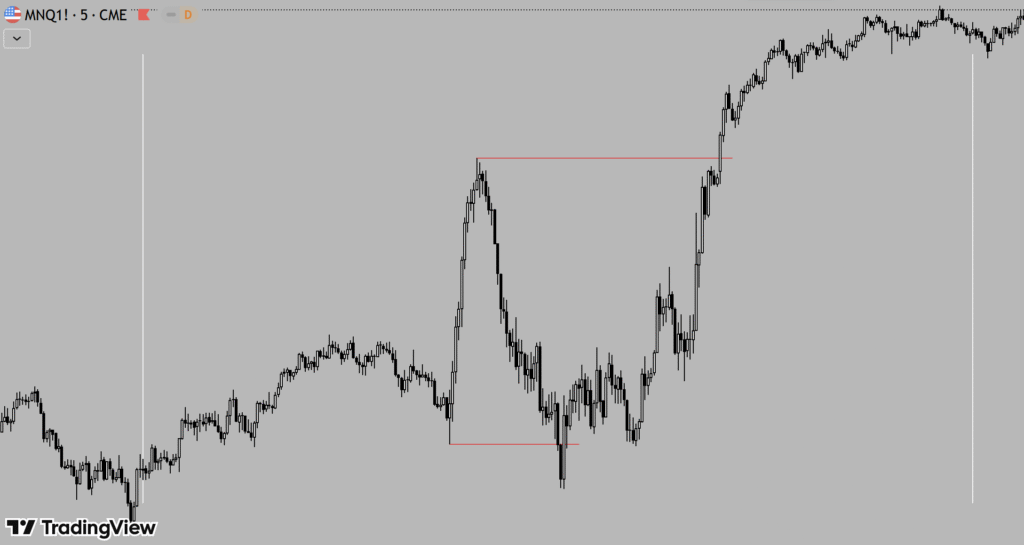

3. Session High & Session Low

Session Highs and Lows are based on specific trading sessions:

- Asia

- London

Each session leaves behind important footprints that price often respects later.

Why Session Levels Work

- Large players accumulate positions during sessions

- Stops are often placed above session highs and below session lows

- Later sessions often target earlier session liquidity

How I Trade Session Levels

- Asia High / Low often gets taken during London & New York

- London High / Low often gets taken during New York

- New York opening range frequently defines intraday bias

- Session highs/lows are excellent scalping targets

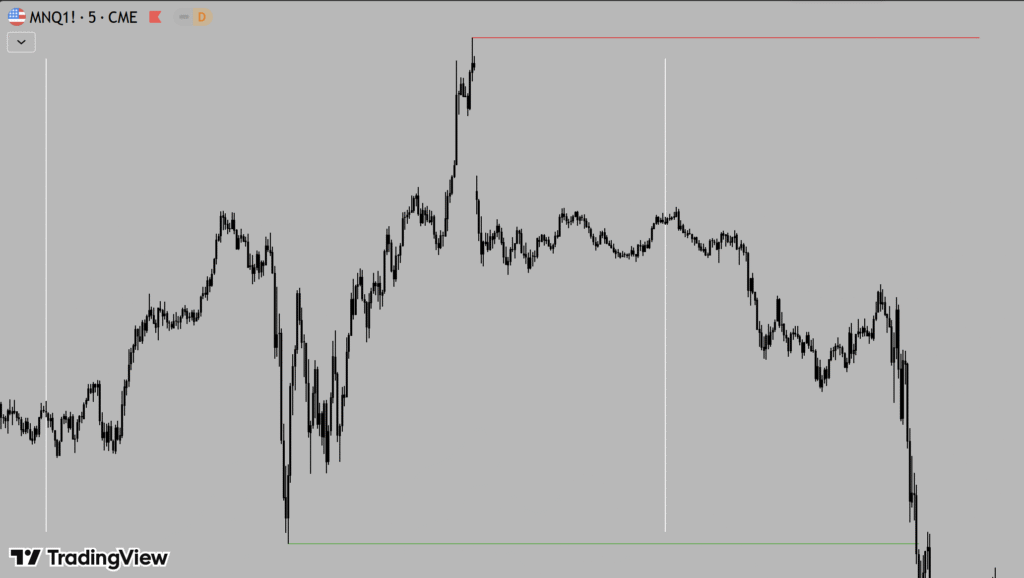

Combining These Levels for Higher Probability Trades

The real power comes when multiple levels align.

High-Probability Confluence Examples

- Previous Day High + Session High

- Daily Low + London Session Low

- Previous Day Low + NY Open rejection

When two or more key levels overlap, the probability of a reaction increases significantly.

Final Thoughts

You don’t need complex indicators to trade futures effectively. Understanding Daily, Previous, and Session Highs & Lows gives you a clear framework for:

- Defining bias

- Identifying liquidity

- Timing entries and exits

These levels are simple, repeatable, and used by traders at every level — from scalpers to institutions.

If you build your strategy around price reacting to key levels, your trading becomes more structured and disciplined.