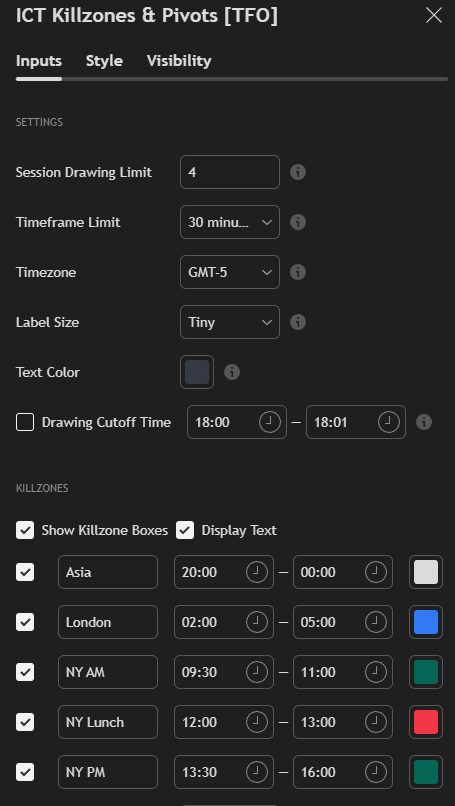

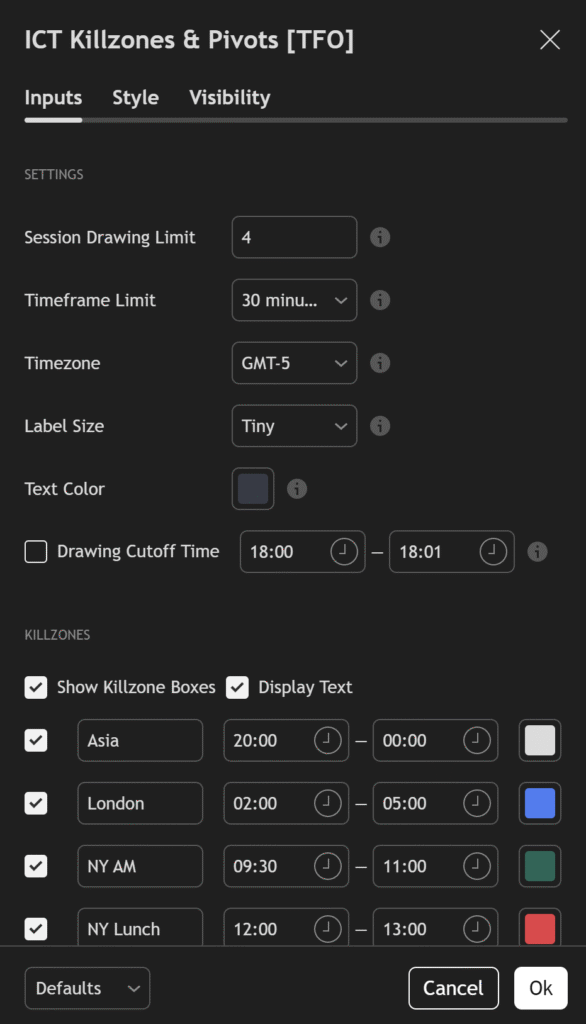

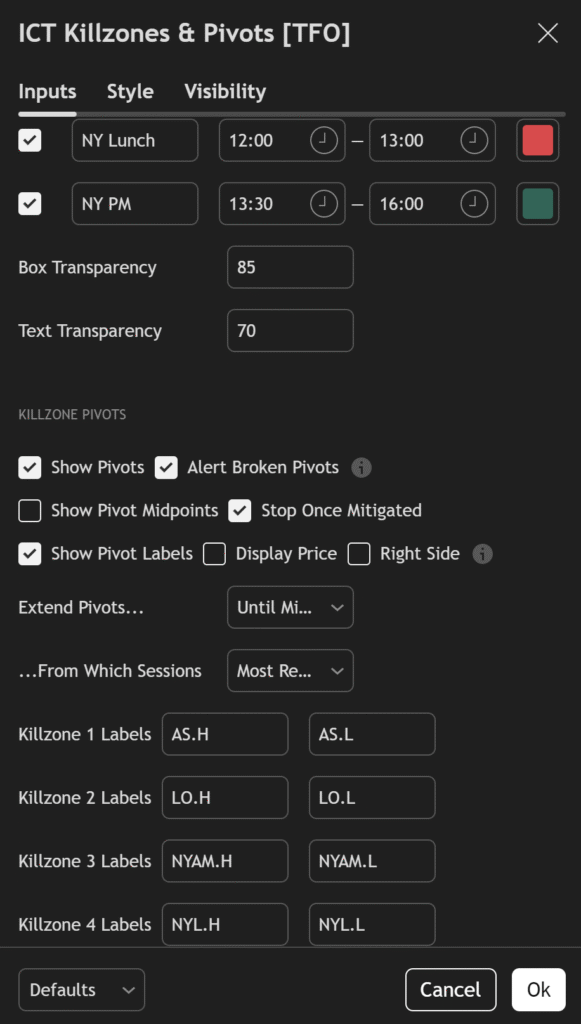

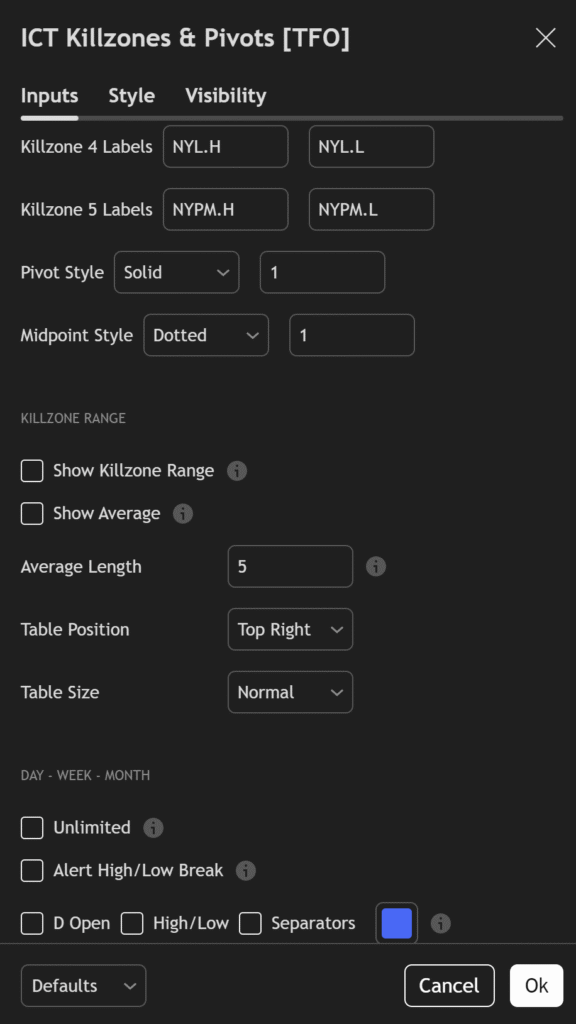

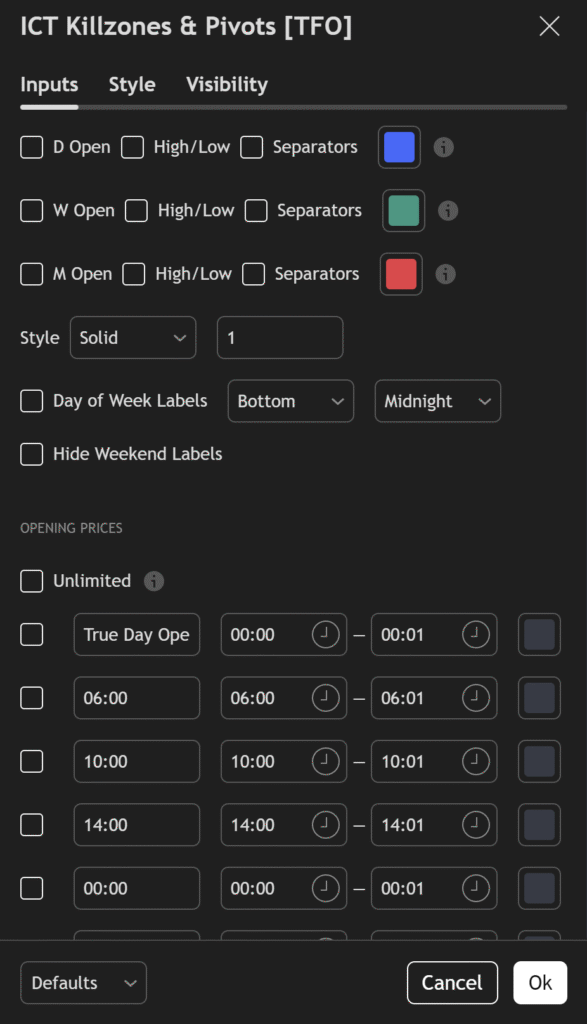

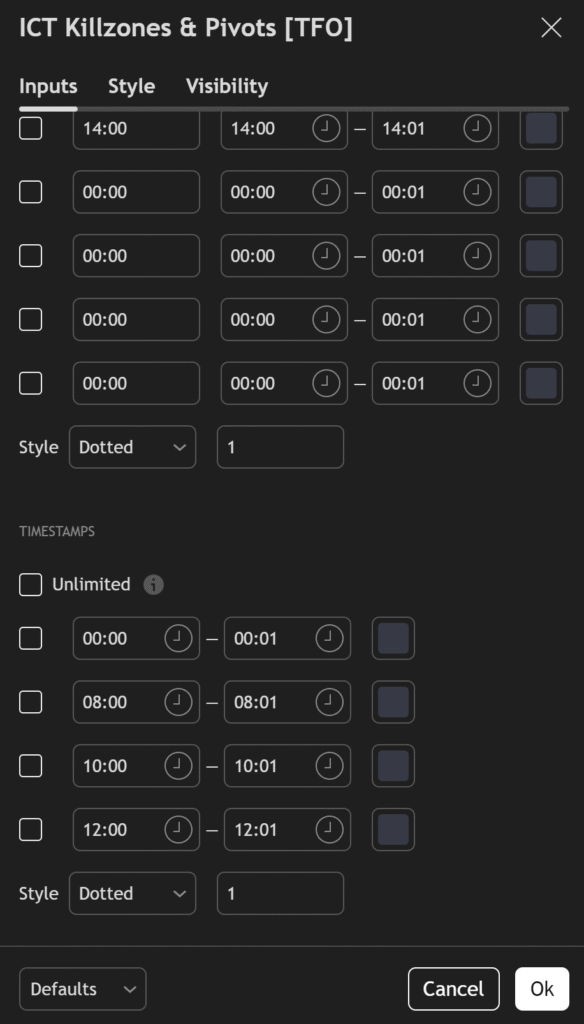

Indicator + Settings shown in the video

ICT Kilzone & Pivots [TFO] indicator: https://www.tradingview.com/script/nW5oGfdO-ICT-Killzones-Pivots-TFO

I’ve attached images of my indicator settings below, stacked one on top of the other, so you can see exactly how I set up the indicator:

The Asian Session (Low Volatility, Range Building)

The Asian session in MNQ is typically characterized by low volatility and tight ranges. Institutional participation is limited compared to later sessions, which makes this period more suitable for range development rather than large directional moves.

Key Characteristics:

- Price often consolidates

- Ranges are formed

- Liquidity pools build above and below the range

- False breakouts are common

How Traders Use the Asian Session:

Many professional traders don’t trade Asia aggressively. Instead, they:

- Mark the Asian high and low

- Treat the range as future liquidity

- Prepare for London or New York to manipulate this range

The London Session (Liquidity Grab and Expansion)

The London session often brings the first real expansion of the day. Although MNQ is a US index, European participation introduces fresh liquidity and directional intent.

What Typically Happens:

- Breaks of the Asian range

- Liquidity grabs above or below Asia highs/lows

- Strong impulsive moves followed by retracements

This is a classic time for stop hunts, where price moves aggressively into resting liquidity before reversing or continuing with structure.

London Kill Zone:

The early London hours are often referred to as a kill zone, where:

- Volatility increases sharply

- Institutional algorithms are active

- High-probability setups appear

Traders using structure, liquidity, and displacement concepts often find excellent opportunities here.

The New York Session (The Main Event)

The New York session is where MNQ truly comes alive. With US equities opening, volume and volatility peak, making this the most important session for intraday traders.

New York Kill Zone:

This period is known as the New York Kill Zone, where:

- Major daily highs or lows are often formed

- Strong trends or sharp reversals occur

- Liquidity from previous sessions is targeted

Price frequently reacts to:

- London highs/lows

- Asian range boundaries

- Previous day high/low

The Lunch Period (Low Probability Zone)

After the morning volatility, MNQ often enters the lunch session, a time where many traders lose money by forcing trades.

Lunch Characteristics:

- Reduced volume

- Choppy, sideways price action

- Algorithms dominate, not institutions

- Breakouts frequently fail

Professional traders often:

- Step away from the charts

- Manage existing positions

- Review the morning session

Understanding that not trading is a position is crucial here.

Putting It All Together

A typical MNQ trading day often looks like this:

- Asia builds a range

- London raids liquidity and creates displacement

- New York delivers the real move

- Lunch consolidates or retraces

Traders who understand this rhythm stop chasing price and start anticipating behavior.

Final Thoughts

Mastering MNQ is not about indicators — it’s about timing, structure, and liquidity. By aligning your strategy with Asia, London, and New York sessions, and respecting kill zones and lunch periods, you dramatically increase your probability of success.

Trade less. Trade smarter. Let the sessions do the work.